These days, qualifying for a home mortgage loan can be near impossible without a decent down payment and a moderate credit score.

If you think you fall under this category, then an FHA loan may be for you!

Due to the recent housing market, the Federal Housing Administration has stepped in (like they did in the Great Depression) to help potential homeowners like you realize the dream of home-ownership.

There are fewer restrictions for FHA loan qualifications in comparison to a conventional mortgage loan.

Here is what is basically needed for an FHA loan:

Income

- Debt-to-Income Ratio – Your monthly mortgage payment should be roughly 45% of your gross income.

- Non-Occupying Co-Borrower Allowed – FHA allows a non-occupying relative to co-sign the mortgage. The non-occupant’s income and assets can be used for qualification purposes. This is generally used for parents to help their children buy a home. The name for this is the “kiddy condo loan”.

Assets

- Little or No Money Needed – FHA loans allow the seller to pay up to 6% of the sales price toward the closing costs. In addition, Congress has for the time being eliminated Down Payment Assistance programs. There is a movement in the legislature to reinstate these community programs. You can however receive a gift from a family member for the down payment. Give your loan officer a call to find up to date guidelines concerning down payment assistance.

- Down Payment – You must pay a minimum of a 3.5% down-payment.

- No Cash Reserves Required – Unlike most conventional loans, FHA does not require you to have cash reserves on 1-2 unit properties. A borrowers profile is graded on an FHA score card. The FHA score card takes into consideration income, assets, job tenure, debt to income ratio’s and credit scores. Having reserves can help strengthen the overall credit profile.

Employment

- 2 Years – Proven employment status of at least 2 years. This doesn’t have to be with the same employer.

- College Grads – If you’re fresh out of college and do not have some work history under your belt, you can use your college years as employment history as long as you have a job lined up.

Property

- Property Types – 1-4 unit, condos, town homes, modular homes, and manufactured homes.

- Living Situation – The property must be your primary residence. No rental properties or vacation homes.

- Housing History – FHA does not require a rental or other housing history if it is not available.

Past Blemishes

- Bankruptcies – Chapter 7 bankruptcies are allowed if discharged over 2 years ago (or 1 year with extenuating circumstances). Chapter 13 bankruptcies are allowed with a minimum of 1 year of on time plan repayment and trustee approval.

- Foreclosures – If you’ve had a foreclosure in the past, you must usually wait at least 3 years to apply.

- On Time Payments – You must have a history of making your credit payments on time. We understand that life happens sometimes, so as long as it’s understandable and can be reasonably documented, it should suffice.

Credit Scores

One of the primary market benefits of a FHA loan has always been that credit scores were not a factor.

A borrower with great credit scores could definitely have their loan approved more easily, but someone with some credit problems could still get approved – provided they had a well documented common sense explanation for their credit problems and could show that the problem had been resolved.

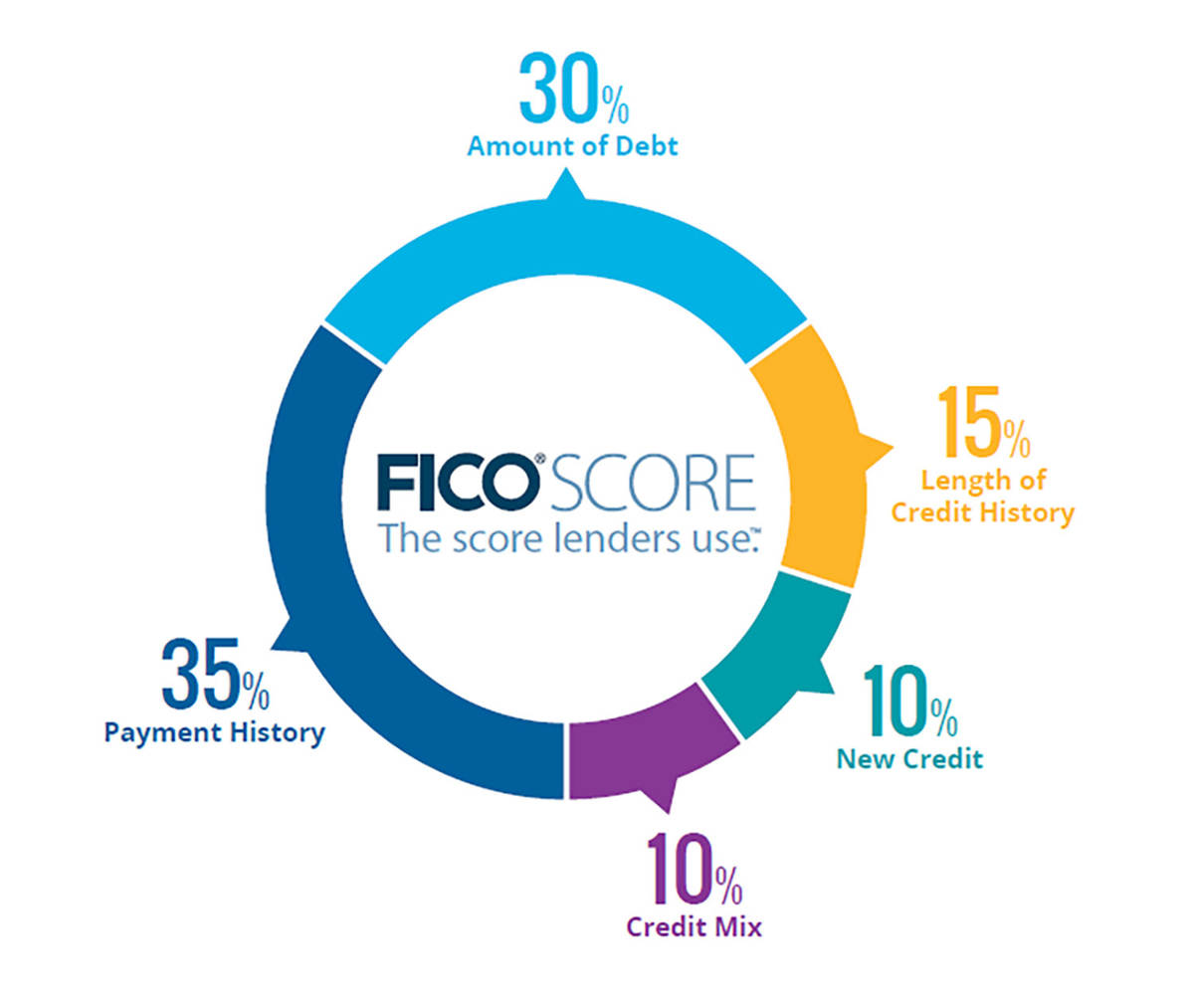

Here’s how your credit score is made up:

In spite of not relying on credit scores, FHA foreclosure rates went down while conventional mortgage foreclosure numbers went up due to their almost excessive reliance on credit scores.

The FHA underwriter will evaluate the entire credit profile to determine the borrower’s likelihood of repayment. Past credit issues may be overlooked if new credit has been re-established. Also, other compensating factors may apply.

Generally a credit score of 580 is needed for automated approval and a few banks will underwrite a file with scores as low as 540, but those “540” lenders usually have a small window where they allow this and quickly cancel those programs.

Documentation

It is very important when you are applying for an FHA loan in Houston that you have a good idea of what documents are needed in the beginning of the FHA mortgage process and can help us expedite the process for you.

Employment

- Last 2 years of W-2’s, 1099’s, or any other proper tax forms

- Last 2 years of filed tax returns (all pages, all schedules). If self employed, we will also need your YTD Profit and Loss statement

- Pay Stubs covering the past (30) thirty days

Assets

- Last 2 months of bank statements (all pages)

- Most recent statement (all pages) for any investment accounts (401(k), IRA, Mutual Fund, etc)

Personal

- Copy of Drivers License or any other official State identification

- Copy of Social Security Card

- Work Permit information and identification

Feel free to contact us if you have any questions regarding any of these things or you can go ahead and check FHA eligibility now!

How to Qualify for an FHA Loan

The main thing to understand is not all of the requirements are set in stone.

Sometimes if there have been circumstances out of your control or you have compensating factors (i.e. you have a lower credit score, but you’re willing to put down a higher down payments), there’s a very good chance you can still get approved.